Difference Between Oqood and Title Deed in Dubai

Navigating Dubai’s real estate system can be challenging for new buyers, particularly when it comes to understanding key legal documents. Among the most important are the Oqood certificate and the Title Deed, both issued by the Dubai Land Department (DLD). While they may seem similar at first glance, they represent different stages of ownership and offer distinct legal protections.

With the rapid growth of off-plan and ready properties across Dubai, from iconic areas like Business Bay to luxury destinations such as Palm Jumeirah, knowing the difference between these two documents is crucial for making informed investment decisions and avoiding costly misunderstandings.

What Is a Title Deed and Why Is It Important

A Title Deed is the final and legally binding document that confirms full ownership of a completed property in Dubai. Issued by the Dubai Land Department (DLD), it serves as the ultimate proof of property rights and is essential for all official and financial transactions, including resale, leasing, inheritance transfers, or applying for a residency visa. Unlike the Oqood, which is provisional, the Title Deed signifies that the property is fully registered under your name and free from ownership disputes.

In 2024, over 56% of all real estate transactions in Dubai involved Title Deed registrations, driven by strong demand for ready-to-move-in properties in areas like Downtown Dubai, Business Bay, and Dubai Marina. The DLD reported a 15% increase in Title Deed issuances compared to 2023, reflecting a surge in end-user purchases and long-term investors favoring completed projects.

Why the Title Deed matters:

- It represents permanent, transferable property rights recognized globally.

- It is mandatory for securing bank financing and property-linked residency visas.

- It protects against fraud or disputes, offering unmatched legal clarity.

For investors, a valid Title Deed is crucial to unlocking property appreciation and long-term financial security.

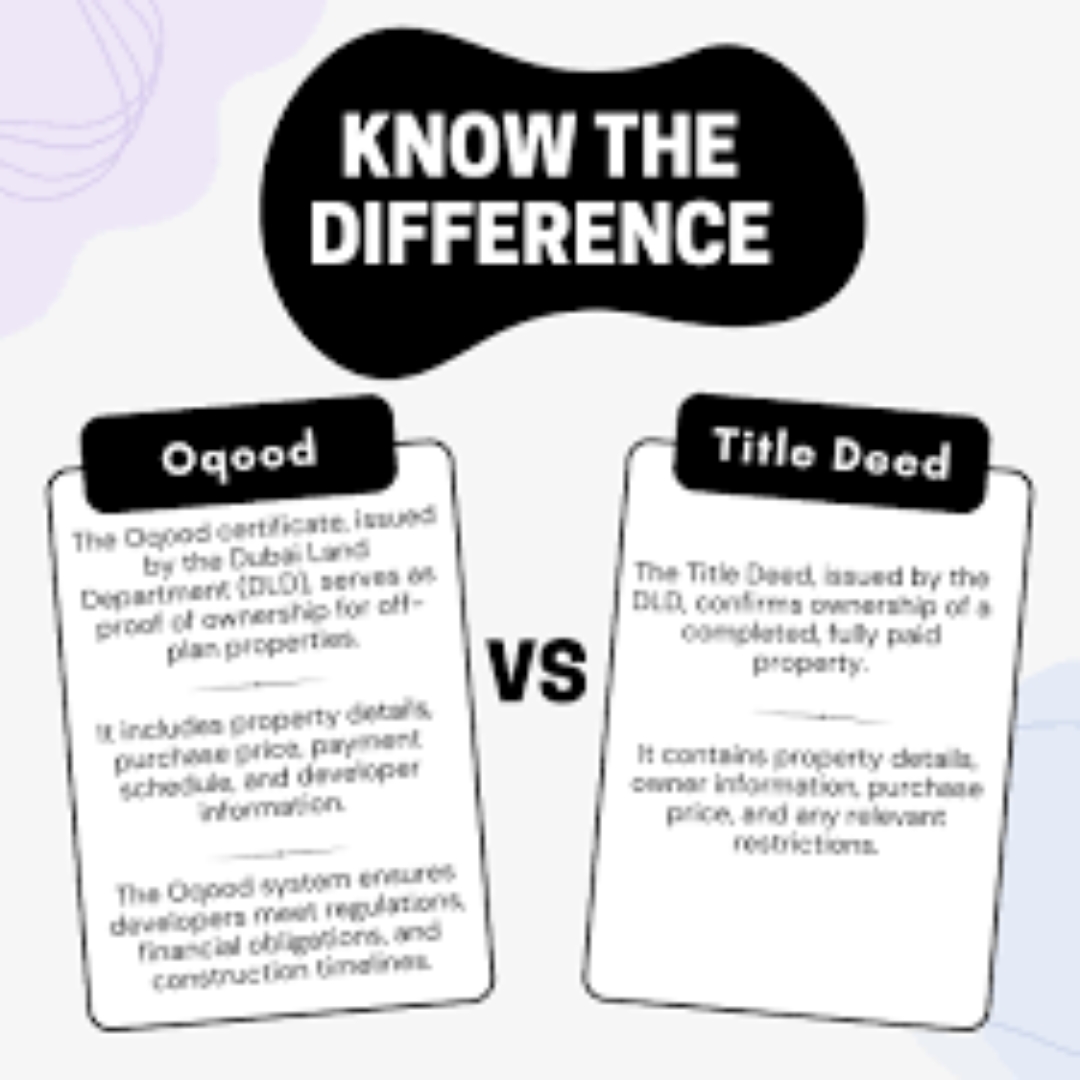

Key Differences Between Oqood and Title Deed

The main difference between an Oqood and a Title Deed lies in the stage of property ownership and the legal rights attached to each document.

1. Ownership Stage: The Oqood is issued by the Dubai Land Department (DLD) for off-plan properties during construction. It acts as a provisional ownership certificate until the project is complete. In contrast, the Title Deed is the final proof of ownership, issued only after the property is fully constructed and handed over to the buyer.

2. Legal Standing : The Oqood provides temporary ownership rights and is replaced by the Title Deed upon completion. The Title Deed is legally binding, recognized by all courts, banks, and government entities in the UAE.

3. Transaction Flexibility: While Oqood properties can be resold before completion, they require DLD approval and payment of a transfer fee, often 4% of the property value. Title Deed properties offer greater flexibility, as they can be easily sold, mortgaged, or leased.

Recent DLD data shows that off-plan transactions accounted for 58% of total property sales in Dubai in 2024, underlining the widespread use of Oqood. Meanwhile, completed property registrations (Title Deeds) increased by 15% year-on-year, driven by high demand in areas like Downtown Dubai and Palm Jumeirah.

Why the Difference Matters for Investors

If you’re diving into Dubai’s real estate market, knowing the difference between Oqood and Title Deed can save you time, money, and headaches. Here’s why these documents matter:

- Oqood

- Acts as provisional ownership during construction

- Protects your rights when buying off-plan properties

- Essential for legal protection before handover

- Acts as provisional ownership during construction

- Title Deed

- Confirms full, permanent ownership after completion

- Needed for resale, leasing, or mortgage applications

- Recognized by banks and government authorities

- Confirms full, permanent ownership after completion

Some eye-opening stats from 2024:

- Off-plan sales made up nearly 58% of all Dubai property transactions.

- Over 85,000 Oqood certificates were issued to secure buyers’ rights during construction.

- Title Deed registrations increased by 15%, driven by demand in prime areas like Business Bay and Palm Jumeirah.

- Banks require the Title Deed to approve mortgage loans, making it essential for long-term investment plans.

Bottom line:

Understanding the distinct roles of Oqood and Title Deed helps you:

- Secure your property early with Oqood

- Unlock full ownership rights with Title Deed

- Avoid delays or legal complications in buying, selling, or financing

Mastering this knowledge lets you confidently navigate every step of your property investment journey in Dubai.

Common Mistakes and How to Avoid Them

Investing in Dubai real estate is exciting, but several common mistakes related to Oqood and Title Deed can cause costly delays or legal issues. Knowing these pitfalls and how to avoid them is crucial.

Common Errors Investors Make:

- Confusing Oqood with Title Deed: Many buyers believe that holding an Oqood means full ownership rights. However, the Oqood only provides provisional ownership during construction. Assuming full rights too early can lead to problems when trying to resell or mortgage the property.

- Not Transferring Oqood to Title Deed: After project completion, some investors delay or neglect the transfer to a Title Deed. According to the Dubai Land Department, over 12% of off-plan buyers face delays in this step, impacting their ability to lease or sell.

- Ignoring Verification: Some buyers skip verifying the Oqood status or fail to track Title Deed issuance, increasing risks of fraud or administrative complications.

How to Prevent These Issues:

- Verify Your Oqood Certificate: Use the official Dubai Land Department website or the Dubai REST app to check your Oqood status regularly. Over 90% of registered Oqood certificates are traceable online, ensuring transparency.

- Request Title Deed Promptly: As soon as the developer hands over the property, apply for your Title Deed immediately to avoid registration backlog, which can sometimes cause delays of up to 6 months.

- Work With Trusted Developers and Agencies: Choosing reputable developers and real estate agents reduces the risk of paperwork errors or fraudulent sales.

By staying vigilant and proactive, investors can safeguard their property rights and enjoy a smoother investment journey in Dubai’s competitive market.

How to Obtain or Verify Oqood and Title Deed

Obtaining and verifying your Oqood certificate and Title Deed are essential steps to secure your property rights in Dubai. Here’s a detailed guide to help you navigate the process smoothly.

Obtaining Your Oqood Certificate

- Sign the Sale and Purchase Agreement (SPA): Once you decide to buy an off-plan property, you sign the SPA with the developer, which is the formal agreement for purchase.

- Pay the DLD Registration Fee: A mandatory 4% Dubai Land Department (DLD) fee on the property value must be paid. This fee ensures your purchase is officially recorded. In 2024, over AED 50 billion was collected by the DLD from such registration fees alone.

- Receive Your Oqood Certificate: After registration, the DLD issues the Oqood certificate, which serves as proof of your provisional ownership. The certificate includes key details like buyer info, property specs, and payment schedule. Over 85,000 Oqood certificates were issued in 2024, reflecting the booming off-plan market.

Obtaining Your Title Deed

- Developer Applies for Title Deed: After the project handover, the developer initiates the transfer process to the Title Deed.

- Settle Pending Charges: You need to clear any outstanding service charges, maintenance fees, or additional DLD fees before transfer.

- Receive the Title Deed: The DLD issues the Title Deed, confirming your full ownership. This document is necessary for resale, mortgage, or leasing.

Verifying Your Documents

Use the Dubai REST app or the official DLD website to verify your Oqood and Title Deed status instantly. These platforms provide real-time updates and are trusted by over 95% of investors for property registration checks.

By understanding this process, you can confidently secure your property rights and avoid delays or legal issues in Dubai’s dynamic real estate market.

Advanced Tips for Property Buyers

Dubai’s real estate market requires more than just basic knowledge of Oqood and Title Deed. Here are advanced tips to help you protect your investment and make informed decisions:

- Verify the Escrow Account Status: Every off-plan project in Dubai must have an escrow account approved by the Real Estate Regulatory Agency (RERA). This ensures your payments are safely held and only released to developers based on construction progress. In 2024, over 120 active escrow accounts were monitored, safeguarding billions in buyer funds. Always request the escrow account details and check that your payments are going into the approved account to avoid fraud.

- Track Project Completion Percentage: Use RERA’s official updates or developer progress reports to monitor the construction status. Projects delayed beyond 6 months are subject to penalties, but buyers can face risks if the developer doesn’t deliver on time. According to DLD data, nearly 12% of off-plan projects faced delays in 2024, making regular progress checks critical.

- Ensure Timely Title Deed Transfer: After project handover, the Oqood certificate must be converted to a Title Deed quickly to secure your full ownership rights. Delays in this transfer can impact your ability to sell, lease, or mortgage the property. Statistics show that properties with timely Title Deed transfers sell 20% faster on average.

- Consult Professionals: Engage with certified real estate agents and legal advisors familiar with Dubai’s property laws to review contracts and documents thoroughly.

By following these tips, you safeguard your investment and enjoy a smoother property ownership journey in Dubai’s dynamic market.

FAQ

What is the main difference between Oqood and Title Deed?

Oqood provides provisional ownership for off-plan properties, while Title Deed confirms full ownership of a completed unit.

Can I sell a property with just an Oqood Certificate?

Yes, but it must be transferred to the buyer through DLD-approved channels.

Do all properties in Dubai require an Oqood?

No, only off-plan properties under construction require Oqood. Ready properties are directly issued with a Title Deed.

How long does it take to get a Title Deed?

It is usually issued shortly after project completion once all fees are cleared.