Dubai Property Growth Stabilizes After Record Year

2026 Begins With Market Balance and Strategic Repricing

Dubai’s real estate market has successfully transitioned from a phase of rapid expansion into a more balanced, strategically driven growth cycle. After recording exceptional price appreciation and transaction activity throughout 2025, the market is now entering a period defined by stabilization, selective growth, and infrastructure-aligned investment performance rather than uniform price inflation.

This shift reflects the maturation of Dubai’s property sector into a sophisticated, globally competitive real estate ecosystem. Rather than weakening fundamentals, stabilization signals a healthier environment where price growth is increasingly supported by infrastructure development, population expansion, and long-term urban planning initiatives.

Investors who adopt a data-driven approach, focusing on infrastructure-aligned locations and high-potential growth corridors, continue to find compelling opportunities across both ready and off-plan segments.

Selective Growth Replaces Broad-Based Expansion

One of the most significant insights from the latest market review is the shift from uniform growth to selective repricing. According to Valorisimo’s analysis, residential price-per-sqft evolution between January 2025 and January 2026 reflects targeted capital deployment rather than widespread price inflation. Growth has concentrated in emerging districts, infrastructure-aligned communities, and waterfront masterplans, while several mature urban zones experienced stabilization or moderate adjustments.

This transition marks a key turning point in Dubai’s real estate investment cycle. During earlier growth phases, strong global demand drove broad price increases across nearly all residential segments. Today, pricing performance increasingly reflects underlying fundamentals such as:

- Infrastructure connectivity

- Development pipeline maturity

- Supply constraints

- Accessibility and affordability

- Long-term urban planning alignment

This is a clear indicator that Dubai’s real estate market is evolving into a more sophisticated investment ecosystem driven by structural factors rather than speculative momentum.

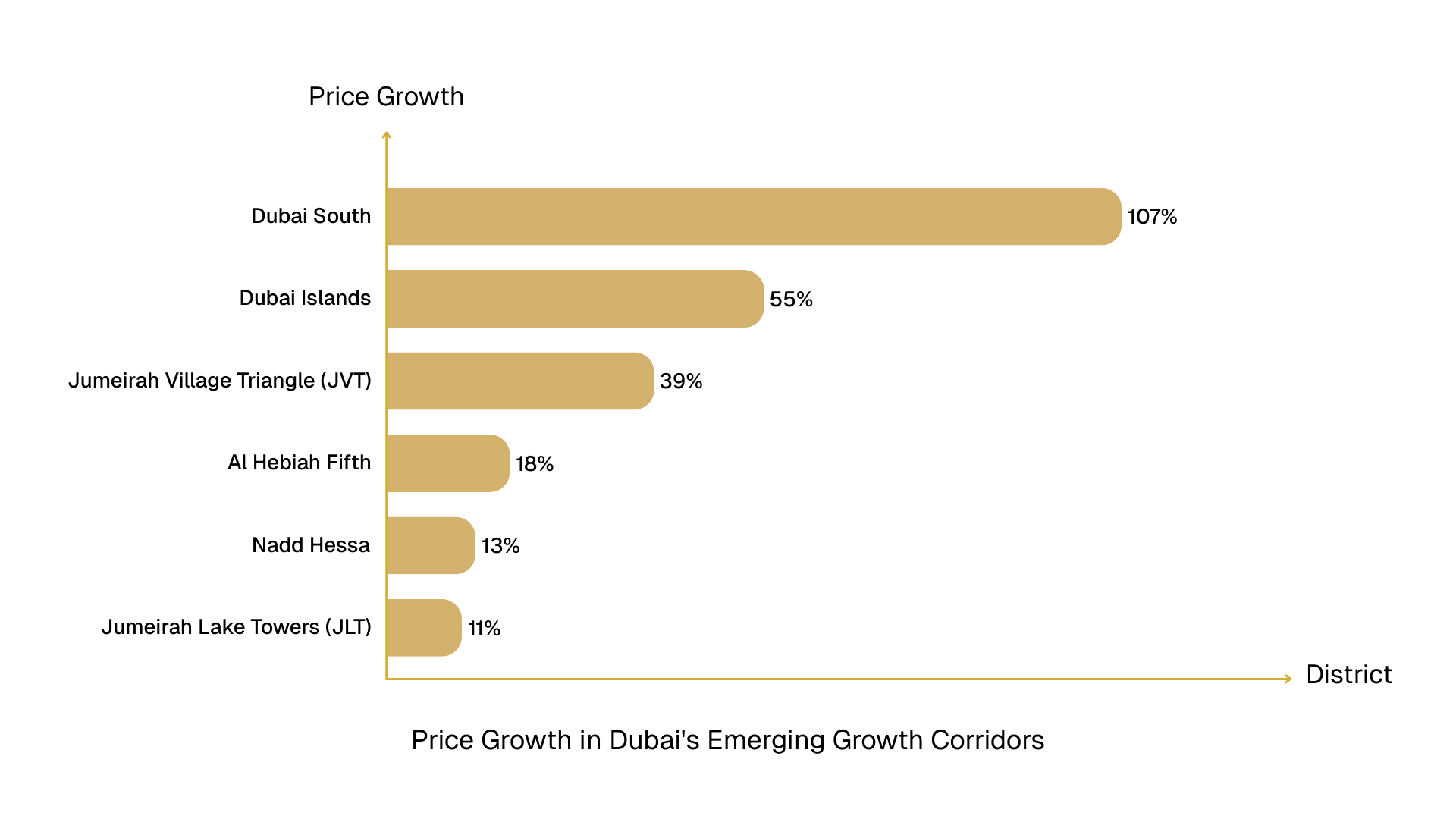

Emerging Growth Corridors Lead Price Appreciation

The strongest price growth over the past year has been concentrated in emerging districts offering affordability, infrastructure access, and long-term development potential.

Among ready apartment communities, Dubai South recorded the highest price-per-sqft growth, rising from AED 580 to AED 1,200—a remarkable 107% increase. This surge reflects strong investor positioning ahead of major infrastructure milestones, including proximity to Al Maktoum International Airport and logistics hubs linked to global trade expansion.

Dubai Islands also emerged as a major growth leader, with prices increasing by 55%, from AED 1,490 to AED 2,310 per square foot. As one of Dubai’s newest waterfront mega-developments, Dubai Islands is benefiting from large-scale master planning, beachfront supply scarcity, and increasing investor demand for coastal living.

- Jumeirah Village Triangle (JVT): +39%

- Al Hebiah Fifth: +18%

- Nadd Hessa: +13%

- Jumeirah Lake Towers (JLT): +11%

These districts share key characteristics: affordability relative to prime districts, strong infrastructure access, and alignment with Dubai’s long-term urban expansion strategy.

This pattern highlights a fundamental market dynamic—capital is flowing toward districts where future growth potential remains high, rather than already-mature premium locations.

Prime Locations Show Stable, Sustainable Growth

While emerging districts led appreciation, established prime locations demonstrated continued resilience through steady, sustainable price growth.

Downtown Dubai recorded a 5% increase in price per square foot, rising from AED 2,710 to AED 2,850. Similarly, Palm Jumeirah saw a 5% increase, confirming ongoing demand for premium waterfront assets. Business Bay and Dubai Hills also recorded steady growth of 7% and 8%, respectively.

This pattern reflects the defensive nature of prime real estate. These districts benefit from:

- Limited land supply

- Established infrastructure

- Strong international demand

- High rental occupancy rates

- Global brand recognition

Rather than explosive growth, prime locations are now delivering stable appreciation and capital preservation—key characteristics sought by long-term investors.

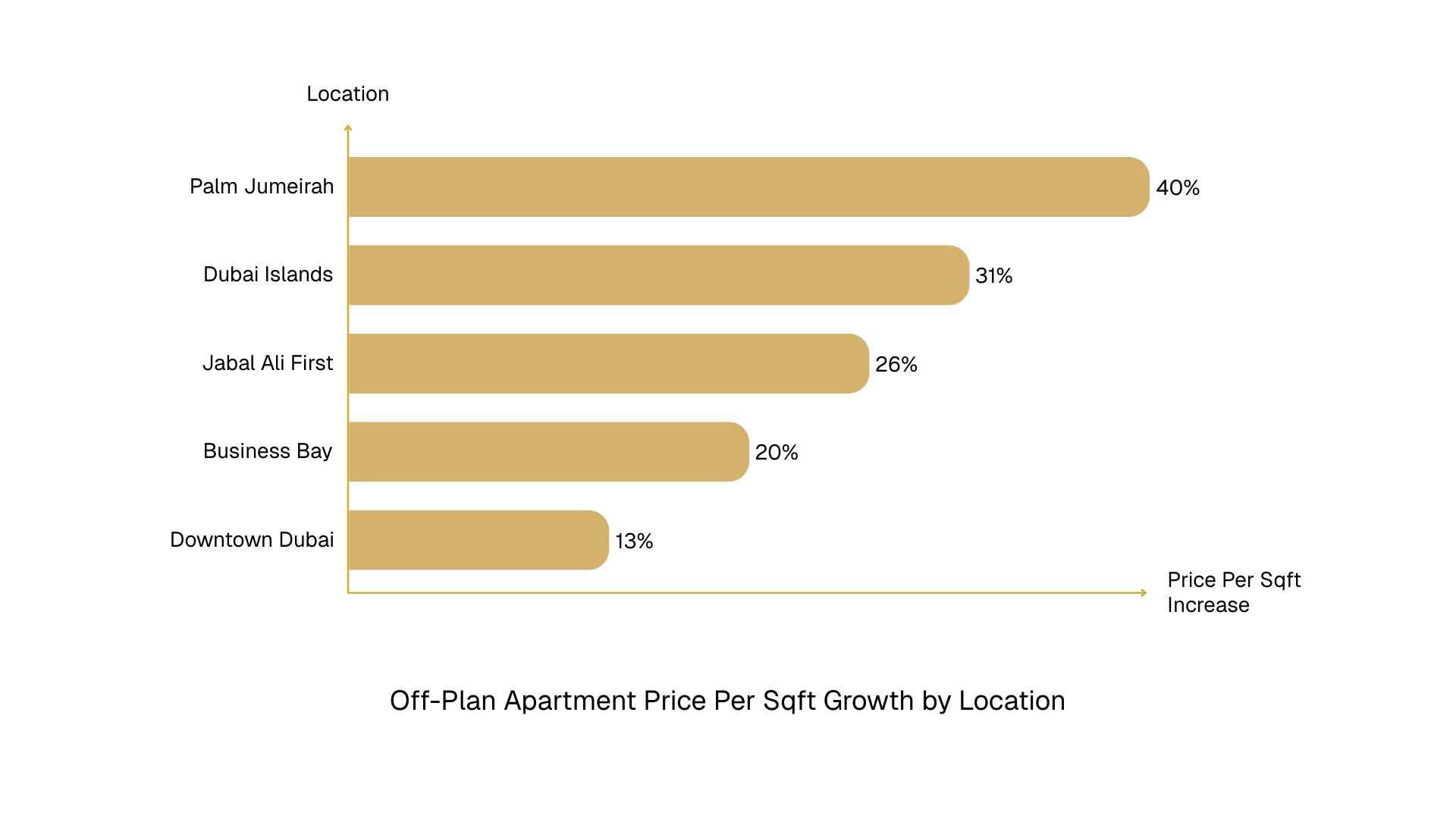

Off-Plan Market Shows Strong Forward-Looking Confidence

The off-plan segment continues to demonstrate strong investor confidence, driven primarily by future infrastructure delivery and masterplan maturity.

Palm Jumeirah led off-plan apartment growth, with price-per-sqft increasing from AED 4,210 to AED 5,910—a 40% increase. Dubai Islands followed with a 31% rise, while Jabal Ali First recorded a 26% increase. Business Bay and Downtown Dubai also saw strong gains of 20% and 13%, respectively.

These trends indicate that investors are positioning early in projects expected to benefit from future infrastructure, tourism expansion, and long-term urban planning initiatives.

Unlike ready properties, off-plan investments reflect expectations about future growth rather than current rental income. This forward-looking nature explains both their strong upside potential and their sensitivity to development timelines.

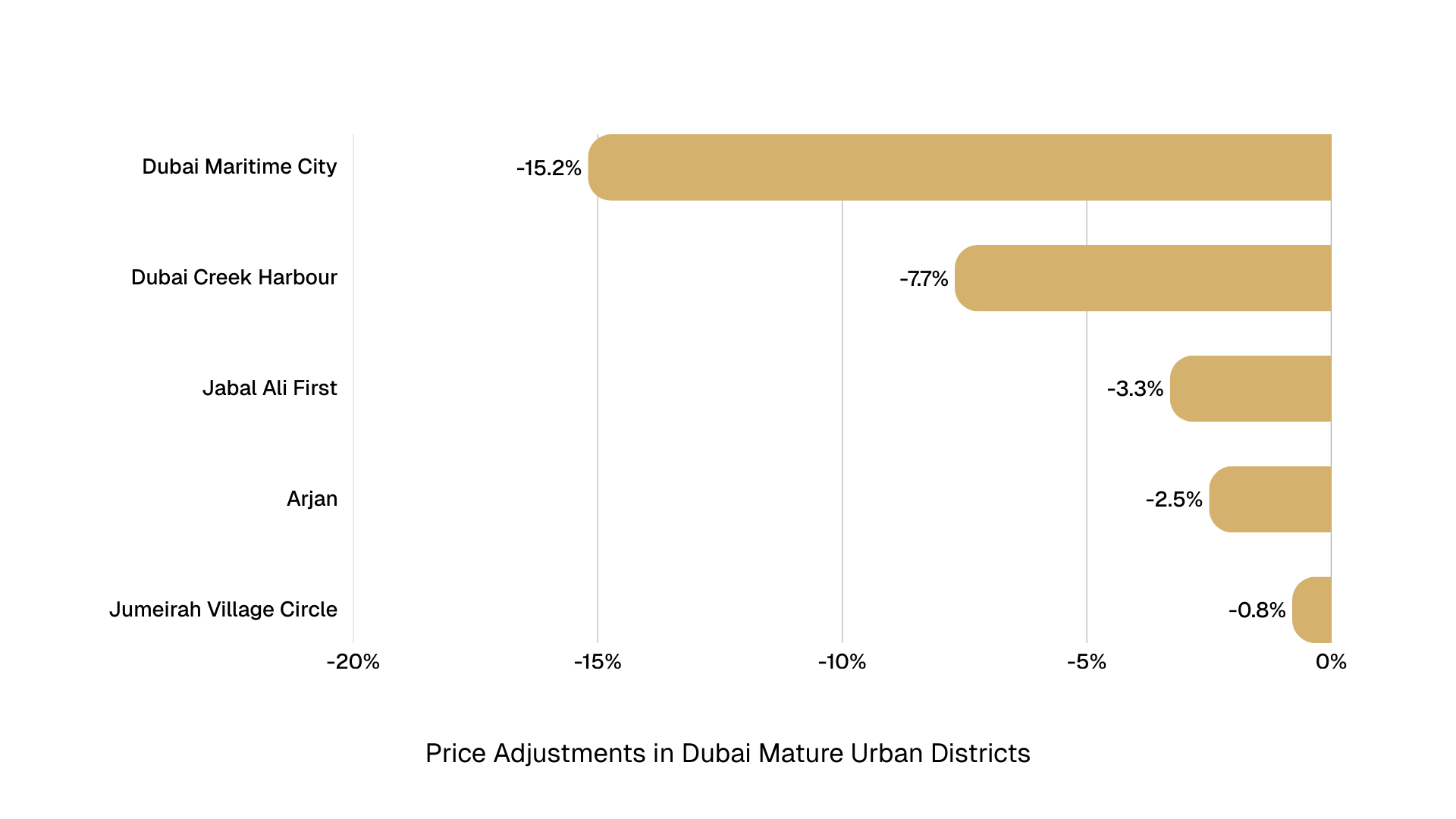

Stabilization in Mature Urban Districts Signals Healthy Market Balance

While many districts experienced growth, several mature areas recorded price stabilization or moderate corrections. This trend is not a negative signal—it reflects market normalization after rapid growth cycles.

Dubai Maritime City experienced a 15.2% price-per-sqft decline, while Dubai Harbour saw a 7.7% adjustment. Jumeirah Village, Arjan, and Jabal Ali First also recorded modest adjustments ranging from –0.8% to –3.3%.

These movements reflect normal price discovery dynamics as supply pipelines mature and pricing benchmarks stabilize.

Importantly, these adjustments are localized and do not indicate structural demand weakness. Instead, they reflect a transition from rapid speculative growth to sustainable, end-user-driven pricing.

Villa Market Emerges as One of the Strongest Performing Segments

One of the most compelling findings in the report is the continued strength of Dubai’s villa market, particularly in premium and master-planned family communities.

Sobha Hartland recorded the highest villa price growth at 32.8%, followed by Emirates Hills and DAMAC Hills. Palm Jumeirah villas also saw strong appreciation, with a median growth rate of 17.7%.

Several structural factors are driving villa demand:

- Land scarcity, which limits supply expansion

- Growing preference for larger living spaces

- Increasing population of high-income expatriates

- Strong end-user demand from families

These characteristics make villas one of the most resilient and defensive real estate asset classes in Dubai.

Off-Plan Villas Demonstrate Strong Growth Potential

Off-plan villas showed particularly strong growth in emerging master-planned communities.

Jabal Ali First recorded a 56.4% increase in price per square foot—the highest among all villa markets analyzed. Palm Jebel Ali also saw strong growth at 23.4%, while Dubai South increased by 21%.

These gains reflect investor confidence in Dubai’s long-term coastal expansion strategy and infrastructure development pipeline.

Investors are increasingly targeting large-scale masterplans aligned with major infrastructure initiatives, including transportation expansion, waterfront development, and economic zone growth.

Cross-Segment Analysis Confirms Strong Market Fundamentals

Comparative analysis across all residential segments confirms that Dubai’s property market remains fundamentally strong, supported by broad-based demand across both ready and off-plan inventory. Rather than relying on a single asset class, price growth has been distributed across villas and apartments, reflecting balanced investor participation and sustained end-user confidence. This diversification is a critical indicator of long-term market stability, reducing the risk of asset-specific volatility and reinforcing Dubai’s position as a mature, resilient real estate market.

Ready villas recorded the strongest average price growth at 19.5% year-on-year, driven by continued demand from families, international relocations, and high-net-worth buyers seeking larger living spaces in established communities such as Dubai Hills Estate, Arabian Ranches, and Palm Jumeirah. Ready apartments closely followed with 19.2% growth, reflecting strong resale activity in prime districts including Downtown Dubai, Dubai Marina, and Business Bay, where limited supply and high rental demand continue to support pricing power.

Off-plan properties also demonstrated robust performance, with off-plan apartments rising 16.7% and off-plan villas increasing 14%, highlighting continued investor confidence in Dubai’s development pipeline. Buyers are increasingly attracted to flexible payment plans, lower entry prices, and the strong capital appreciation potential associated with emerging communities such as Dubai South, Jumeirah Village Circle, and Dubai Creek Harbour. The steady growth in off-plan segments confirms that investors maintain a long-term outlook, positioning themselves ahead of future infrastructure expansion and population growth.

Key insights from cross-segment performance include:

- Villas outperform apartments in capital appreciation, reflecting limited supply and strong end-user demand from relocating families and international buyers.

- Ready properties continue to lead price growth, driven by immediate occupancy availability and strong resale market liquidity.

- Off-plan segments remain highly attractive,offering lower entry points and significant upside potential as projects progress toward completion.

- Balanced growth across all property types signals market maturity, reducing speculative risk and strengthening long-term investor confidence.

- Sustained demand across both investor and end-user segments confirms structural market strength, rather than short-term speculative activity.

This balanced growth across asset classes demonstrates that Dubai’s property market is entering a more sustainable phase, characterized by steady appreciation rather than unsustainable spikes. With continued population expansion, infrastructure investment, and international capital inflows, all major residential segments remain well-positioned to deliver stable returns and long-term capital growth for investors.

Infrastructure-Aligned Locations Drive Long-Term Value Creation

One of the most significant conclusions from the latest market analysis is the increasing role of infrastructure alignment as a primary driver of property value and long-term capital appreciation. Real estate performance in Dubai is no longer determined solely by traditional prime versus secondary classifications. Instead, districts that benefit from direct connectivity to major infrastructure projects—including airports, metro lines, logistics corridors, coastal masterplans, and integrated urban developments—are consistently delivering stronger price growth, higher rental demand, and improved investment resilience.

Areas such as Dubai South are a clear example of this trend. The district’s proximity to Al Maktoum International Airport, which is planned to become the world’s largest airport with a projected capacity of over 260 million passengers annually, positions it as a future global aviation and logistics hub. As infrastructure expansion progresses, demand for residential and mixed-use developments in Dubai South continues to rise, driving steady capital appreciation and rental growth. Similarly, Dubai Islands is emerging as a major waterfront investment destination, supported by extensive coastal infrastructure, hospitality developments, marina facilities, and tourism expansion. These infrastructure investments enhance long-term desirability and strengthen property value fundamentals.

Jabal Ali First also demonstrates strong infrastructure-driven growth potential due to its strategic proximity to Jebel Ali Port—the largest port in the Middle East—and expanding logistics corridors. As global trade volumes increase and the UAE strengthens its position as a logistics and manufacturing hub, residential demand in adjacent areas is expected to grow significantly. Palm Jebel Ali, another major coastal expansion project, reflects Dubai’s long-term vision of creating world-class waterfront communities. With improved road connectivity, hospitality developments, and integrated urban planning, Palm Jebel Ali is positioned to become one of the most valuable coastal real estate corridors over the next decade.

Infrastructure development has historically been one of the most reliable predictors of long-term real estate appreciation in Dubai. As the city continues investing billions into transport networks, aviation capacity, and master-planned communities, infrastructure-aligned locations will remain among the strongest performers, offering both capital growth and sustained rental demand.

Market Segmentation Becomes the Dominant Investment Theme

Another defining shift in Dubai’s real estate market is the increasing segmentation of performance across different neighborhoods, property types, and development stages. Unlike earlier cycles where the market often moved uniformly, current trends show that price growth, rental performance, and investor demand vary significantly depending on micro-location fundamentals and asset characteristics.

This segmentation reflects the maturation of Dubai’s real estate market into a more sophisticated and data-driven investment environment. Performance is now strongly influenced by location-specific drivers such as infrastructure connectivity, proximity to employment hubs, lifestyle amenities, and supply constraints. For example, waterfront communities, infrastructure-linked districts, and master-planned residential developments are outperforming oversupplied or less strategically positioned areas.

Asset typology is also playing a crucial role. Villas, particularly in family-oriented communities, continue to experience strong demand due to population growth, lifestyle migration, and international relocation trends. Meanwhile, apartments in emerging districts are attracting investors seeking higher rental yields and lower entry points. Development stage further impacts performance, with off-plan properties offering higher appreciation potential, while completed properties provide immediate rental income stability.

As a result, investors can no longer rely on broad market assumptions. Instead, successful investment strategies require granular, data-driven analysis focused on individual communities, infrastructure alignment, and long-term demand drivers. This segmentation trend highlights the growing importance of professional market intelligence and strategic investment planning.

Why Dubai’s Real Estate Market Remains One of the World’s Strongest

Despite transitioning into a more balanced and sustainable growth phase, Dubai continues to offer some of the strongest real estate investment fundamentals globally. The emirate’s long-term economic strategy, combined with favorable government policies and strong demographic growth, ensures sustained demand for residential and commercial property across multiple segments.

One of the most important drivers is population growth. Dubai’s population has surpassed 3.7 million and continues to expand steadily, driven by international migration, business expansion, and long-term residency initiatives such as the Golden Visa program. This population growth directly supports housing demand, rental occupancy, and long-term property value appreciation.

Global investor demand remains exceptionally strong, as Dubai continues to attract capital from Europe, Asia, the Middle East, and North America. Investors are drawn by the city’s favorable tax environment, which includes zero property tax, no capital gains tax, and no inheritance tax on real estate. This tax efficiency significantly enhances net investment returns compared to most global property markets.

Dubai’s world-class infrastructure further strengthens its investment appeal. The city offers advanced transport networks, global aviation connectivity, modern urban planning, and continuous infrastructure expansion. Combined with political stability, economic diversification, and a business-friendly regulatory framework, Dubai provides a secure and predictable environment for real estate investment.

These structural advantages ensure that Dubai remains one of the most attractive global destinations for property investors seeking both income generation and long-term capital appreciation.

Strategic Investment Opportunities for 2026 and Beyond

Based on current market performance and infrastructure-driven growth, the most promising real estate investment opportunities in Dubai are concentrated in infrastructure-aligned corridors, emerging waterfront districts, and master-planned residential communities. These areas benefit from strong population growth, improved connectivity, and long-term urban development strategies, which collectively support sustained demand, rental stability, and capital appreciation.

Infrastructure-linked districts such as Dubai South, Jabal Ali First, and areas surrounding airport and metro expansions offer significant long-term upside. As connectivity improves and commercial ecosystems develop, residential demand and property values in these locations are expected to rise steadily. These corridors are increasingly attracting both end-users and investors seeking early exposure to future prime zones.

Waterfront developments, including Dubai Islands and Palm Jebel Ali, also present strong investment potential. Historically, Dubai’s waterfront communities have delivered above-average capital appreciation due to limited supply, lifestyle appeal, and international buyer demand. These emerging coastal projects allow investors to enter at relatively competitive price levels before full infrastructure and community maturity.

Master-planned communities such as Dubai Hills Estate and Arabian Ranches remain highly attractive due to their integrated infrastructure, including schools, retail centers, parks, and healthcare facilities. These developments offer long-term value stability, strong rental demand, and consistent appeal among families and professionals.

Off-plan projects in strategic locations continue to provide attractive entry points, flexible payment structures, and strong appreciation potential as construction progresses. Overall, Dubai’s real estate market is entering a more stable and mature phase, and investors focusing on infrastructure-aligned locations and emerging growth districts will be best positioned to achieve sustainable rental income and long-term capital growth.

Conclusion: Stabilization Signals Market Strength, Not Weakness

Dubai’s real estate market has successfully transitioned from rapid expansion into a stable, strategically driven growth phase.

Emerging districts continue to deliver strong appreciation, prime areas offer stable value preservation, and infrastructure-aligned communities present exceptional long-term potential.

This evolution confirms Dubai’s position as one of the world’s most resilient, sophisticated, and investor-friendly real estate markets.

For investors who adopt a data-driven approach and focus on infrastructure-aligned growth corridors, Dubai continues to offer some of the most attractive real estate opportunities globally.